30+ Debt to income ratio for house

Please cite this indicator as. Your mortgage property taxes and homeowners insurance is 2000.

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

The 2836 rule is an addendum to the 28 rule.

. Divide the purchase price of a similar property by that annual rent number. Compare that with needing an income near 150000 if you put down only 20. Monthly debt payments monthly gross income X 100 DTI ratio For example your income is 10000 per month.

Plug these rent and purchase figures in addition to your down payment and income into our handy calculator. But it might give you pause. Use this to figure your debt to income ratio.

A back end debt to income ratio greater than or equal to 40 is generally viewed as an indicator you are a high risk borrower. Debt-burden ratio DBR is the ratio of an individuals total monthly outgoing payments including installments towards loans and credit cards to the total income. And mortgage lenders will often have in-house caps on DTI ratio that can vary depending on the borrowers.

As you can see by saving 20 of your income youll hit 25 times your annual income in about 30 years. A debt-to-income ratio DTI or loan to income ratio LTI is a way for banks to measure your ability to make mortgage repayments comfortably without putting you in financial hardship. A debt-to-income ratio is the percentage of gross monthly income that goes toward paying debts and is used by lenders to measure your ability to manage monthly payments and repay the money borrowed.

Most responsible lenders follow a 36 percent back-end DTI ratio model unless there are compensating factors. Shows what portion of your income is needed to cover all of your monthly debt obligations plus your mortgage payments and housing expenses. A house and land package loan or.

The United States Government Debt is estimated to have reached 13720 percent of the countrys Gross Domestic Product in 2021. 20 should be immediately saved goals or retirement or put towards paying down debt. Divide 900 by 3000 to get 30 then multiply that by 100 to get 30.

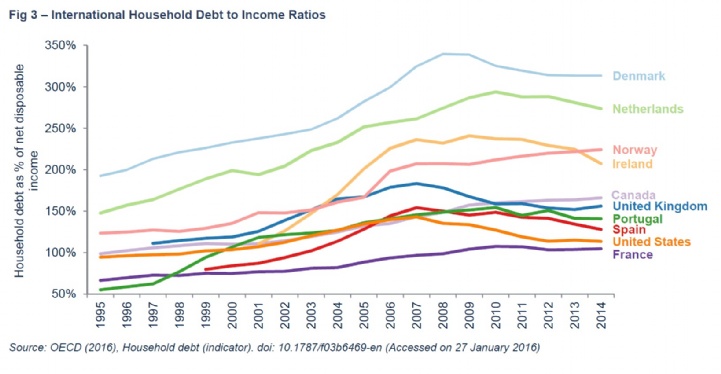

The indicator is measured as a percentage of net household disposable income. There are two kinds of DTI ratios front-end and back-end which are typically shown as a percentage like 3643. To find your DTI ratio divide all of your required monthly debt payments by the amount you earn before taxes.

When youre buying a house your debt-to-income ratio influences the size of the loan and the interest rate youll qualify for. You must earn an after-tax income of at least 1000 per month to be eligible. Take the first step toward the right mortgage.

A ratio greater than 20 generally weighs in favor of renting while a figure less than 20 generally favors buying. This is important because it can have a big impact on your qualifying debt-to-income ratio DTI. 2836 are historical mortgage industry standers which are.

Borrowers with a high DTI ratio may have a high credit utilization ratio which accounts for 30 percent of your credit score. For example if you pay 1000 a month in debt bills and you bring home 2000 a month before taxes your DTI ratio is 50. 30-Year Fixed 15-Year Fixed FHA Loan VA Loan USDA Loan Jumbo Loan YOURgage.

How To Pay Medical Bills You Cant Afford. This percentage is known as the back-end ratio or your debt-to-income DTI ratio. Your debt-to-income DTI ratio compares how much money you earn versus the amount of your debt.

10X Your Annual Salary Life Insurance Ratio. This includes credit card bills car. By default this calculator uses a 28 front-end ratio housing expenses versus income a 36 back-end ratio monthly housing plus debt payments versus income though these are variables in the calculator which you can adjust to suit your needs the limits set by your lender.

This means your DTI is 30. The budgeting ratio says the order is important. When you spend more than 30 of your income on rent you may find yourself limited when it comes to spending on other expenses and putting away money into.

30 is widely considered to be the standard rent-to-income ratio. Interest only loans were particularly wound back with approvals limited to 30 per cent of a lenders total loan book. This page provides - United States.

Figure Out How Much You Can Afford. The process of buying a house after a divorce or while legally separating from your spouse can be tricky. Calculate Your Debt to Income Ratio.

With 30 down you could potentially afford a 1037000 home on an income of 140000. Lowering your credit utilization ratio will help boost. How to calculate your home.

If youre spending 30 or less of your monthly income on rent then youre most likely in a healthy financial situation. Age X Pretax Income 10 Net Worth Ratio. For your convenience we list current Redmond mortgage rates to help homebuyers estimate their monthly payments find local lenders.

20-30-50 Budgeting Ratio. In general the lower the percentage the better the chance you will be able to get the loan or line of credit you want. Government Debt to GDP in the United States averaged 6454 percent of GDP from 1940 until 2021 reaching an all time high of 13720 percent of GDP in 2021 and a record low of 3180 percent of GDP in 1981.

The loans have repayment terms of three to 72 months. Houshold debt is defined as all liabilities of households including non-profit institutions serving households that require payments of interest or principal by households to the creditors at a fixed dates in the future. Your debt-to-income ratio also determines whether youre eligible for the type of loan you want and improving your DTI can help you get lower mortgage rates.

A low debt-to-income ratio demonstrates a good balance between debt and income. This includes credit cards car loans utility. Save 25X Your Current Income Retirement Savings Ratio.

But theres more to this ratio than meets the eye. 30 should be the. 28 of your income will go to your mortgage payment and 36 to all your other household debt.

That means a 30-year-old who starts saving today assuming no prior savings will hit this target by age 60. Debt Snowball vs Avalanche. The debt-to-income ratio is an underwriting guideline that looks at the relationship between your gross monthly income and your major monthly debts giving VA lenders an insight into your purchasing power and your ability to repay debt.

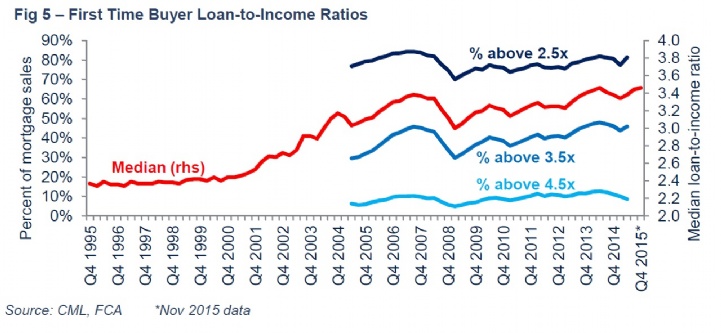

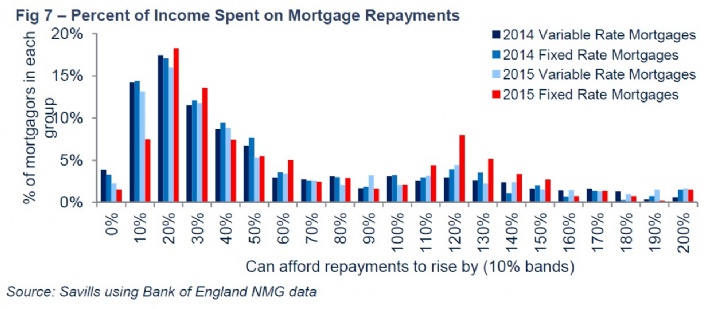

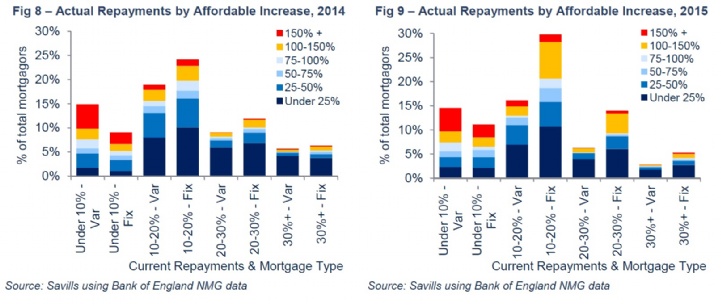

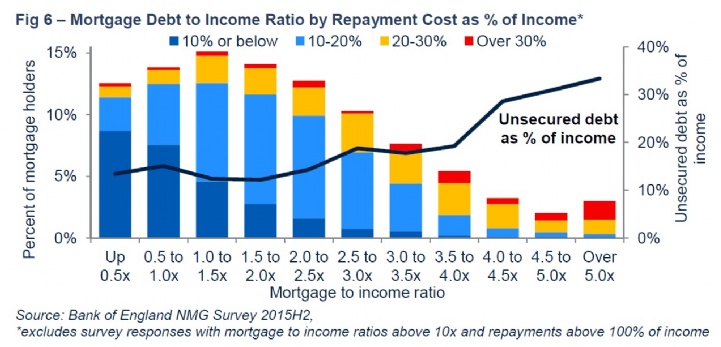

Savills Household Debt

When Banks Evaluate My Debt To Income Ratio Is Income Accounted For The Gross Revenue I Bring In From Work Or Net Income After All My Living Expenses Quora

Pin On Best Of One Mama S Daily Drama

Savills Household Debt

.jpg)

Savills Household Debt

Guaranteed Rate Affinity Mortgage Rates 5 31 Review Details Origination Data

What Is The Debt To Income Ratio And Why Is It Important Quora

Pin On Life After College

Savills Household Debt

Savills Household Debt

.jpg)

Savills Household Debt

What Bills Are Calculated In The Debt To Income Ratio Quora

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

Top 3 Best Income Statement Template Printable For You You Calendars Income Statement Statement Template Profit And Loss Statement

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

Savills Household Debt

Business Balance Sheet Template Free Download Balance Sheet Template Statement Template Business Letter Template